Financial Literacy in Challenging Times

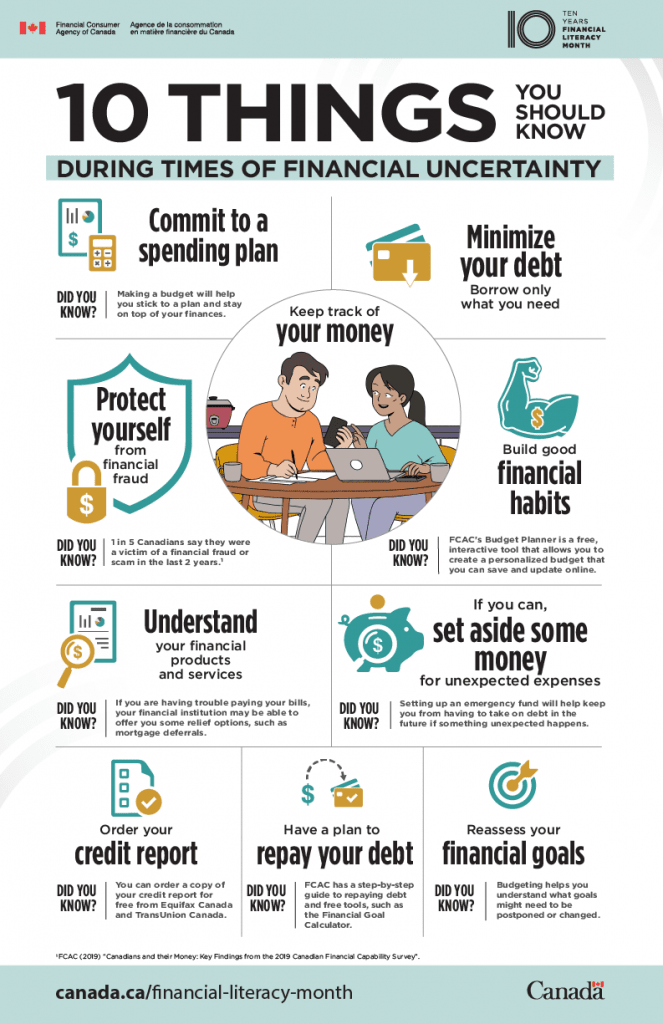

COVID has had a big economic impact. That’s why this year’s focus for Financial Literacy Month is helping Canadians learn how to manage their finances in challenging times.

The Financial Consumer Agency of Canada provides tips and tools to help.

Looking for an introductory financial literacy program for adult learners?

ABC Money Matters offers three programs that may help you. They include Money Matters Core program, Money Matters for Indigenous Peoples, and Money Matters for People with Diverse Abilities. Host organizations can organize workshops and receive support with print workbooks. There are also some online resources available for students to use on their own.

Looking for financial information addressing specific COVID concerns?

Chartered Professional Accountants Canada has created a COVID-19 financial literacy resources page. This answers questions such as:

- “I lost my job. What do I do now?”

- “I’m a parent. What resources are available?”

- “I’m a business owner. Where’s help?”

- and more.

Coronavirus: Your Legal Questions Answered is a resource from People’s Law School. It offers clear language guidance to British Columbians on common legal questions including:

- Money and debt

- Consumer questions

- Business questions.

Helping Canadians Manage Their Finances During COVID-19, from the Canadian Bankers Association, describes some financial literacy programs and relief programs. It includes links to the dedicated COVID-19 websites of various Canadian banks.

Related Blog Posts

Financial Literacy: Managing Debt

November is Financial Literacy Month and we’re outlining some tips and resources for managing debt.

New in the Decoda Library! January 2021

Borrow new resources! The Decoda Literacy Library continuously adds titles to the collection. Here’s a sample of the latest additions.

HyperDocs for Remote and In-Person Learning

Learn about HyperDocs, a useful tool for remote and in-person learning.