Financial Literacy for Children

It’s the fourth week of Financial Literacy Month and the theme is Start good habits early.

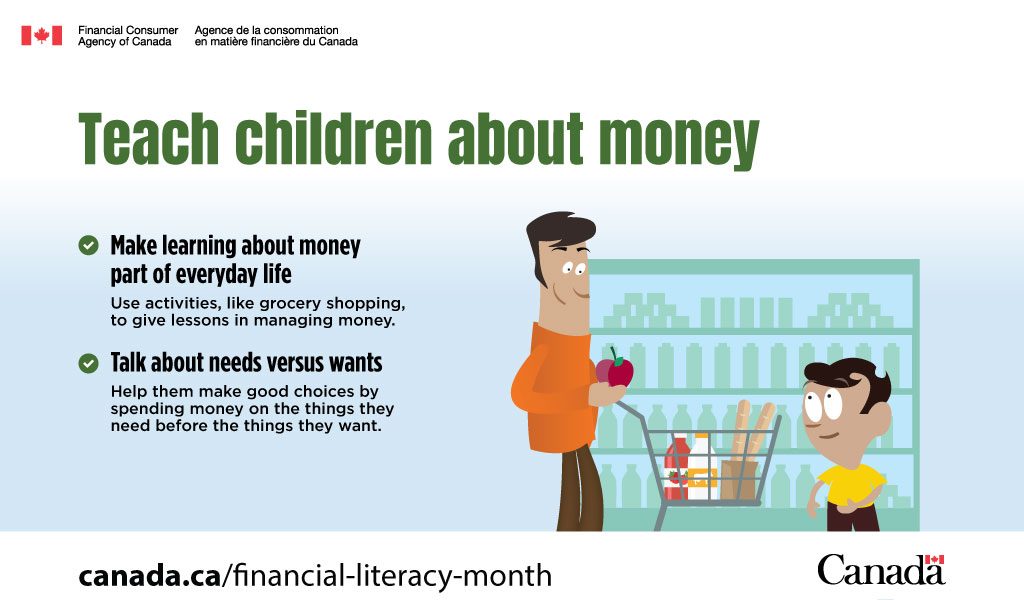

Financial literacy is an essential life skill and children can start learning about money when they’re young. Lessons in managing money can be embedded in family activities. Shopping, planning a trip or going to the bank are opportunities to introduce financial concepts, to explain the difference between needs and wants, and to talk about budgeting decisions.

Here are some places to find tips on teaching children about money:

- Expert tips on how to make “the money talk” painless for your kids – and you

- For Me, for You, for Later: First Steps to Spending, Sharing, and Saving

- Start good habits early

- Talking to kids about money: An age-appropriate guide

- Teaching children about money

- The best picture books to help raise money-smart kids

This week is also Canada Education Savings Week. It’s a time to raise awareness of the various government incentives available through Registered Education Savings Plans (RESPs) and also free money that’s available through scholarships, grants and bursaries. To learn more, visit Education funding. Another good source of information about RESPs and the Canada Learning Bond is SmartSaver.

Related Blog Posts

What to Read to Babies

When parents are reading to them, babies are learning, even when they don’t understand all the words. Some research indicates that both quality and quantity of the reading matter. So …

How are ‘I Spy’ books made?

The “I Spy” book series has captured the imagination of millions of readers. Part of what made these books so magical is that all of the images were created with …

Stress and Trauma Impact Children’s Learning

Stress and trauma make it difficult for a child to learn.